Variable Costing: Advantages, Disadvantages, and Examples

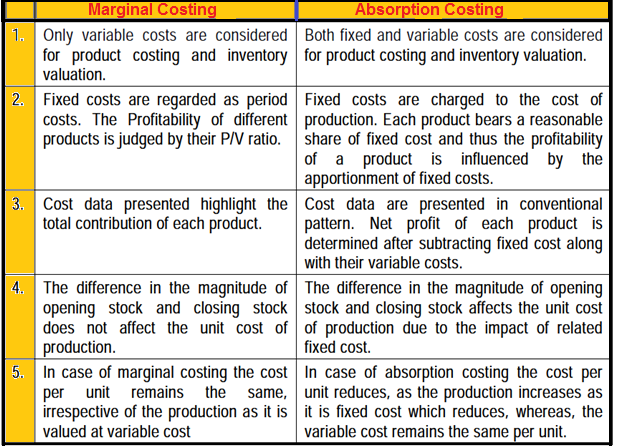

Two main methods of calculating product costs are direct and absorption costing. Direct costing assigns the direct costs of producing a good or service to that product. Absorption costing assigns all production costs, including indirect costs, to a product. Absorption costing is a method of costing that includes all manufacturing costs, both fixed and variable, in the cost of a product. Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively.

- Contribution margin under variable costing is defined as sales revenue less variable product costs.

- It does not include a portion of fixed overhead costs that remains in inventory and is not expensed, as in absorption costing.

- The variable cost per unit is $22 (the total of direct material, direct labor, and variable overhead).

- Examples of standard variable costs include wages, rent, utilities, and materials.

Not Suited to Product Line Comparison

This can help managers make better decisions about pricing, product mix, and other aspects of manufacturing. Utilities such as electricity and water, can also be considered variable costs. Variable overhead includes costs such as electricity information returns and supplies that vary with production volume. Fixed overhead includes costs such as rent and property taxes that do not vary with production volume. Absorption costing results in a higher net income compared with variable costing.

Absorption and Variable Costing Problems and Solutions

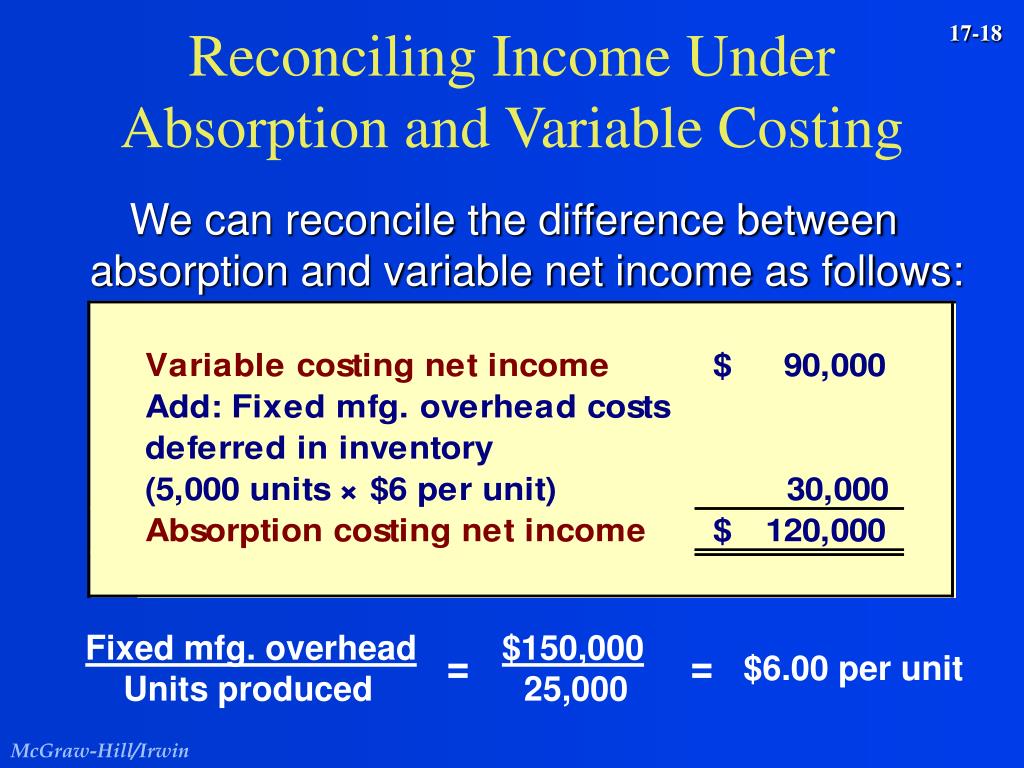

In this example, fixed overhead is lower under absorption costing due to $5,000 being stuck in inventory at the end of the period. This results in lower cost of goods sold and higher net income under absorption costing. Variable costing is a valuable management tool but it isn’t GAAP-compliant and it can’t be used for external reporting by public companies. A company may also have to use absorption costing which is GAAP-compliant if it uses variable costing. Both costing methods can be used by management to make manufacturing decisions.

Variable Cost vs. Fixed Cost: What’s the Difference?

Using the absorption costing method on the income statement does not easily provide data for cost-volume-profit (CVP) computations. In the previous example, the fixed overhead cost per unit is $1.20 based on an activity of 10,000 units. If the company estimated 12,000 units, the fixed overhead cost per unit would decrease to $1 per unit. Compared to variable costing, absorption costing results in higher total product costs and lower net income in periods with lower production volumes. This occurs because fixed overhead costs are allocated across fewer units produced. Absorption costing is a costing method that allocates both variable costs and fixed manufacturing overhead costs to each unit produced.

How is absorption costing treated under GAAP?

The key difference between variable and absorption costing lies in the treatment of fixed manufacturing overhead costs. Under absorption costing, they are allocated to units produced as product costs. If absorption costing is the method acceptable for financial reporting under GAAP, why would management prefer variable costing? Advocates of variable costing argue that the definition of fixed costs holds, and fixed manufacturing overhead costs will be incurred regardless of whether anything is actually produced.

Why is absorption costing more widely used then variable costing?

Absorption costing may be more suitable for companies that have a high proportion of fixed manufacturing overhead costs and stable inventory levels. It provides a comprehensive view of the cost of production and can help in setting appropriate selling prices to cover all costs. The different treatment of fixed manufacturing overhead costs in absorption costing and variable costing also affects the valuation of inventory. Under absorption costing, fixed manufacturing overhead costs are included in the cost of inventory, whether it is finished goods, work-in-progress, or raw materials. This means that fixed manufacturing overhead costs are carried forward in inventory until the goods are sold.

Because Nepal does not carry inventory, the income is the same under absorption and variable costing. Carefully study the arrows that show how amounts appearing in the absorption costing approach would be repositioned in the variable costing income statement. Since the bottom line is the same under each approach, this may seem like much to do about nothing. But, remember that “gross profit” is not the same thing as “contribution margin,” and decision logic is often driven by consideration of contribution effects. Further, when inventory levels fluctuate, the periodic income will differ between the two methods.

Fixed overhead costs are considered period costs and are expensed in the period incurred, rather than allocated to units produced. The total of direct material, direct labor, and variable overhead is \(\$5\) per unit with an additional \(\$1\) in variable sales cost paid when the units are sold. Additionally, fixed overhead is \(\$15,000\) per year, and fixed sales and administrative expenses are \($21,000\) per year. Under absorption costing, each unit in ending inventory carries $0.60 of fixed overhead cost as part of product cost. Therefore, ending inventory under absorption costing includes $600 of fixed manufacturing overhead costs ($0.60 X 1,000 units) and is valued at $600 more than under variable costing.

By allocating fixed manufacturing costs to inventory, absorption costing better matches expenses to revenues. A company may also be required to use the absorption costing method for reporting purposes if it prefers the variable costing method for management decision-making purposes. This is significant if a company ramps up production in advance of an anticipated seasonal increase in sales. Therefore, absorption costing is a system of costing where in addition to the variable costs, the fixed costs of production are also absorbed into the cost of the product.

Many companies use both methods, depending on the type of product being produced and the nature of the company’s operations. For example, a company manufacturing products with high indirect costs would likely use absorption costing. In contrast, a company that sells many different products might use direct costing.

The fixed overhead would have been expensed on the income statement as a period cost. The allocation of fixed overhead to units produced means net income is lower than under variable costing, which treats fixed overhead solely as a period cost. However, absorption costing adheres to GAAP and provides a fuller valuation of inventory.